The FED interest rates play a pivotal role in shaping the global financial landscape. Whether it’s traditional assets like stocks and bonds or modern digital assets like Bitcoin, changes in these rates send ripples through the market. But what exactly are these rates, and why do they matter?

Historically, rate cuts have spurred investment in high-risk assets like crypto. As the FOMC (Federal Open Market Committee) gears up for its next meeting, the crypto market awaits with anticipation. The key question is: Will the FED’s decision boost the bull run for Bitcoin and Altcoins?

In this article, we’ll explore how the FED interest rates impact both traditional and digital markets, and what to expect from the upcoming FOMC meeting.

Understanding FED Interest Rates

The FED interest rate, also known as the federal funds rate, is a tool used by the Federal Reserve to manage the economy. It controls the cost at which banks lend to each other overnight. When the FED raises or lowers this rate, the effects extend far beyond just the banking sector.

Raising interest rates is a tool to curb inflation, making borrowing more expensive and slowing economic activity. On the other hand, lowering rates encourages borrowing, leading to more spending and investment. For investors, this has a direct impact on various asset classes, influencing decisions to invest or hold.

Why do these changes matter? When rates are low, investors tend to seek higher returns, often turning to riskier assets like stocks or cryptocurrencies. Rate hikes tend to have the opposite effect, leading to a sell-off in riskier markets as safer options like bonds become more attractive.

Historical Impact of Rate Cuts on Traditional Assets

Historically, rate cuts by the Federal Reserve have had a positive impact on traditional asset markets. Lower rates make borrowing cheaper, encouraging companies to take on more debt to expand their businesses, which in turn boosts stock prices.

For example, during the 2008 financial crisis, the FED slashed interest rates to near-zero levels to stimulate the economy. This move helped revive the stock market, leading to one of the longest bull markets in history. Similar effects were seen in 2020 when rate cuts helped the stock market recover after the COVID-19 pandemic.

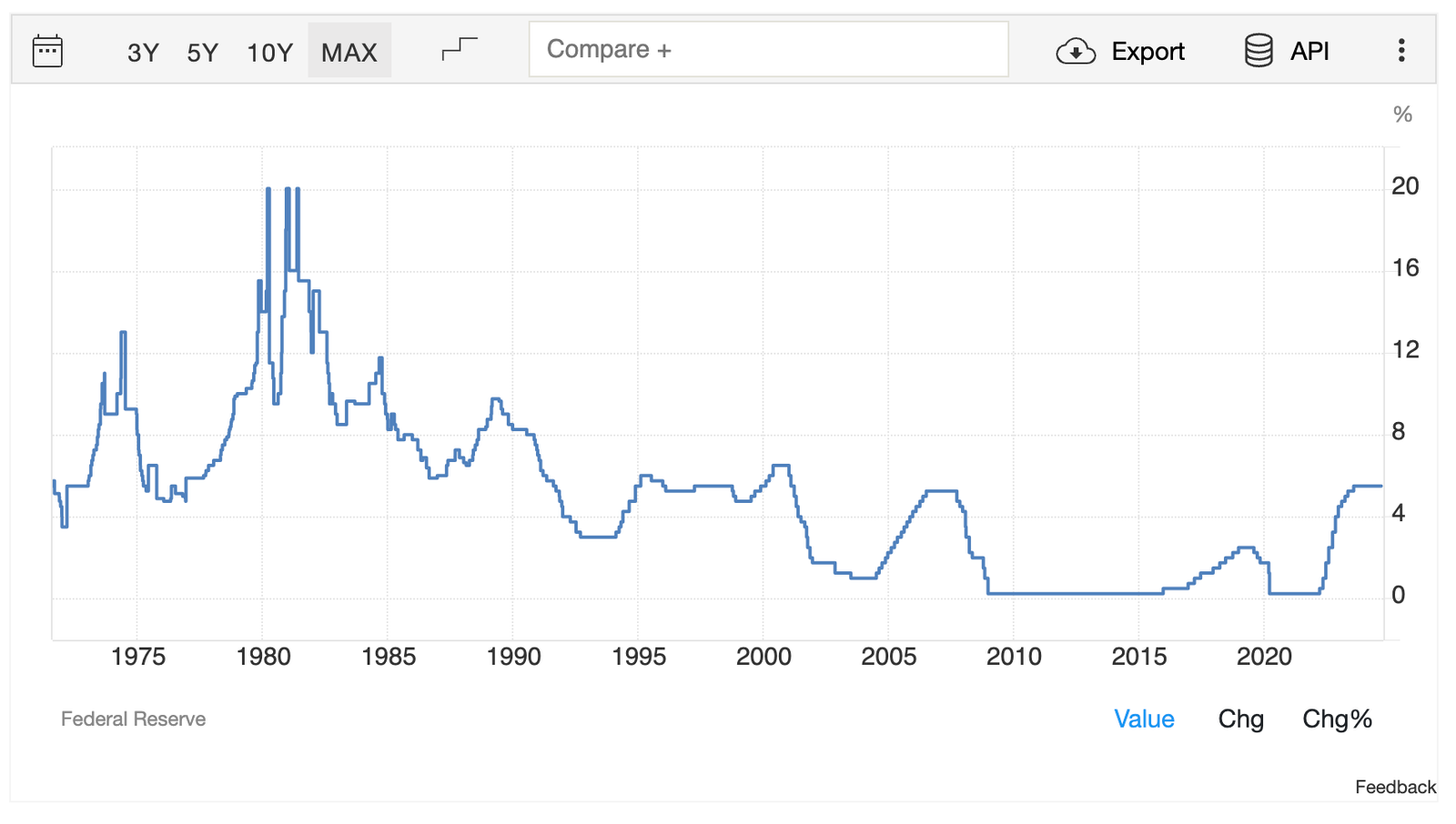

Source : Trading Economics ( Post COVID the FED interest rates cut helped the crypto market start a new rally )

Commodities like gold, often seen as a hedge against inflation, also tend to rise when rates are cut. This is because low interest rates reduce the opportunity cost of holding non-yielding assets like gold, making them more attractive to investors. The historical patterns in traditional markets give us a glimpse of how significant FED rate decisions can be for various asset classes

Historical Impact of Rate Cuts on Bitcoin and Crypto

Bitcoin and cryptocurrencies have increasingly responded to changes in FED interest rates, especially during periods of rate cuts. When the FED slashes rates, liquidity flows into risk-on assets like crypto, as investors seek high returns in a low-yield environment.

A notable example was the FED’s rate cuts during the COVID-19 pandemic in 2020. As rates dropped, Bitcoin saw an explosive rally, climbing from $5,000 in March 2020 to over $60,000 by April 2021. The cheap borrowing rates and excess liquidity in the market fueled this surge.

Lower rates often drive investors toward speculative assets like Bitcoin, due to the limited returns available in traditional financial markets. As borrowing becomes cheaper, retail and institutional investors alike are more willing to take risks in pursuit of higher yields, making rate cuts a catalyst for crypto bull runs.

However, it’s important to note that while rate cuts generally boost the crypto market, external factors like regulatory news or major technology advancements can also play a role in shaping crypto’s trajectory.

Rate Hikes and Their Impact on Bitcoin and Crypto

While rate cuts often stimulate the crypto market, rate hikes can have the opposite effect. When the FED increases rates, it raises the cost of borrowing. Investors shift from riskier assets like cryptocurrencies to safer options such as bonds or stable income-generating investments.

For instance, throughout 2022, as the FED embarked on aggressive rate hikes to combat inflation, Bitcoin’s price faced substantial declines. From an all-time high of nearly $69,000 in November 2021, Bitcoin dropped below $20,000 in mid-2022, largely due to rising interest rates and reduced liquidity in the market.

When interest rates rise, borrowing becomes more expensive, and speculative investments like cryptocurrencies tend to suffer. Investors reduce exposure to high-volatility assets, seeking more stable returns in bonds or savings accounts. This can create downward pressure on crypto prices, leading to bear markets.

However, it’s crucial to note that the relationship isn’t always linear. External factors like geopolitical tensions, technological developments, and adoption trends also play a role in crypto price movements.

Why This Month’s FOMC Meeting Matters for Crypto

The upcoming FOMC meeting has garnered significant attention, particularly from crypto enthusiasts. The FED is expected to announce a rate cut as excpected by many, which could set the tone for the remainder of the year. With Bitcoin trading sideways for weeks, many are wondering if this meeting could be the catalyst for the next big move.

Historically, FED decisions around interest rates have had an immediate impact on crypto markets. If the FED opts for a rate cut, we could see liquidity pouring back into riskier assets like Bitcoin. Investors, emboldened by the cheaper borrowing costs, might flock to crypto in search of higher returns.

On the other hand, if the FED signals a break and considreing the rate cuts for later, the market could react negatively, with a potential sell-off in crypto assets. Traders and investors often act preemptively based on FED announcements, so the upcoming meeting could be pivotal for the remainder of the year. Understanding the FED’s language and tone during these meetings can provide valuable insight into where crypto might head next.

Could FED Rate Cuts Trigger the Next Crypto Bull Run?

One of the most debated questions in the crypto community is whether the FED’s future rate cuts will spark the next bull run. Historically, rate cuts have created favorable conditions for high-risk assets, including cryptocurrencies, to flourish.

During periods of low interest rates, investors are incentivized to seek returns in risk-on assets. This is why rate cuts, when paired with other bullish market conditions, often act as a spark for a new bull run in Bitcoin and altcoins.

For instance, after the FED slashed rates in response to the COVID-19 pandemic, Bitcoin soared to new heights. Many investors see the potential for a similar move if the FED embarks on a cycle of rate cuts this year. The combination of reduced borrowing costs, increased liquidity, and growing interest in decentralized finance (DeFi) could create a perfect storm for a significant crypto rally.

While it’s impossible to predict market behavior with certainty, the historical correlation between rate cuts and rising asset prices is strong. Crypto enthusiasts are watching closely for signs that a sustained period of rate cuts might fuel the next major bull market.

Other Economic Factors Influencing the FED’s Decisions

While interest rates are a major tool for managing the economy, they aren’t the only factor at play. The FED also takes into account inflation, employment data, GDP growth, and global economic conditions when making rate decisions. These factors can create a more complex landscape for crypto investors to navigate.

For example, if inflation remains stubbornly high, the FED may delay rate cuts to prevent the economy from overheating. Conversely, weak employment data or slowing GDP growth could prompt the FED to lower rates, injecting more liquidity into the system.

Geopolitical tensions, trade policies, and changes in commodity prices can also influence the FED’s rate-setting decisions. Crypto markets, which are highly sensitive to macroeconomic trends, often react swiftly to these developments. While the FED’s interest rates are a critical piece of the puzzle, investors must consider the broader economic picture when making decisions.

TL;DR

The FED’s interest rate decisions significantly influence asset markets, including cryptocurrencies. Historically, rate cuts have been bullish for Bitcoin and crypto, driving liquidity into these assets. With the upcoming FOMC meeting, the crypto market is closely watching for potential rate changes. A rate cut could lead to a positive impact on crypto prices, while a hike might dampen momentum. The FED’s approach to inflation, economic growth, and employment will be key factors in their decision, shaping the outlook for crypto.

Key Takeaways

- Interest rate cuts by the FED have historically boosted asset markets, especially Bitcoin and crypto.

- Rate hikes tend to decrease liquidity, often leading to market pullbacks.

- The FOMC’s upcoming meeting could signal another rate adjustment, affecting short-term and long-term crypto trends.

- Investors are watching inflation trends and economic indicators, which influence the FED’s decisions and market reactions.

- Rate cuts usually result in more liquidity, attracting investors to riskier assets like cryptocurrencies.

Conclusion

FED interest rates have always had a powerful influence on the markets, and crypto is no exception. Historically, periods of rate cuts have aligned with bullish runs in Bitcoin and other cryptocurrencies, as liquidity flows into higher-risk assets. On the flip side, rate hikes have generally caused slower growth or even market declines, as investors move to safer assets. As the FOMC prepares for its next meeting, the question of whether the FED will continue its tightening policy or pivot toward rate cuts remains critical. For crypto investors, understanding how FED decisions impact liquidity and asset flows is essential to navigating potential market moves. The next FED decision could mark a significant turning point for the market, and being prepared is key.