The 2024 U.S. election season has become a pivotal moment for the cryptocurrency industry. With key candidates like Donald Trump and Kamala Harris representing different economic visions, crypto investors are watching the political landscape more closely than ever. This article examines the potential impacts of US Elections and crypto market trends, regulatory shifts, and the overall future of digital assets in the U.S.

Crypto and the US Elections

As the 2024 elections gain momentum, they have brought crypto into the spotlight. Cryptocurrencies have already seen increased market activity and investor speculation. The current U.S. election cycle, featuring a growing interest in digital assets, underscores how integral cryptocurrency has become to both the financial world and the political arena.

The Political Landscape’s Influence on Crypto

In previous election cycles, the US Elections and crypto industry was less of a focus. However, the 2024 elections reflect a shift in priorities. Now, the stakes are higher for crypto, as the community itself has become a significant player in the political landscape, actively engaging in campaign contributions and policy influence. With nearly half of all political donations directed toward pro-crypto candidates or causes, the community has demonstrated a strong interest in shaping future regulations.

✓ Key Points:

- Increased Political Engagement: The crypto community has increased donations and political involvement.

- Desire for Regulatory Clarity: Political contributions aim to influence policies that could bring clarity to the industry.

- Economic Implications: Candidates’ economic policies could heavily impact crypto’s future.

This engagement reflects a broader trend of industries recognizing the influence of politics on their sustainability, especially with cryptocurrency still lacking complete regulatory clarity.

Trump: The Bullish Candidate for Crypto?

While Donald Trump once held a critical view of cryptocurrency, his recent pro-crypto stance reflects a shift that could impact market sentiment positively. By positioning the U.S. as a potential “bitcoin superpower,” Trump taps into the aspirations of many crypto supporters. His rhetoric aligns with the community’s goal for minimal government interference in digital assets, which could imply deregulation and new policies encouraging adoption.

- Economic Growth Focus: Trump’s narrative ties crypto growth to national economic prosperity, creating positive sentiment for the market.

- Regulatory Leeway: If elected, Trump’s approach may lead to a relaxed regulatory environment.

- Market Reactions: The crypto market may respond to pro-crypto sentiments with increased investment and interest.

His campaign’s economic promises and favorable digital asset stance have made him popular with pro-crypto voters. This positioning marks a potential shift in national policy that aligns with the industry’s long-term goals for minimal restrictions and innovation-friendly regulations.

Kamala Harris: A Bearish Outlook for Crypto?

Kamala Harris, in contrast, presents a vision focused on economic stability and oversight, which could suggest a less favorable environment for cryptocurrency. While her campaign hasn’t explicitly criticized digital assets, her economic stance leans toward consumer protection and responsible innovation, hinting at a regulatory approach that may limit unfettered crypto expansion.

- Stabilization Over Speculation: Harris’s policies may focus on curbing speculative excesses and protecting consumer interests.

- Emphasis on Stability: Prioritizing stability over growth could dampen the crypto bull run.

- Regulatory Influence: Her administration might introduce tighter regulations or oversight, creating bearish pressures on the market.

Although her approach could bring more stability, it may hinder the sector’s growth potential by imposing restrictions seen as counter to the spirit of decentralization and innovation that characterizes cryptocurrency.

Market Sentiment and Election Outcomes

The crypto market’s reaction to election events illustrates the sensitive nature of digital assets to regulatory changes. Election anticipation has led to heightened volatility in the prices of Bitcoin, Ethereum, and other assets. Market participants closely monitor election polls and candidate statements, often responding with cautionary or speculative buying, depending on projected outcomes.

- Price Fluctuations: Election-related news leads to increased trading volume, impacting crypto valuations.

- Anticipation of Regulatory Impacts: Investors weigh the effects of potential policy shifts and regulatory changes.

- Sentiment-Driven Volatility: With election uncertainty, some crypto investors choose defensive strategies, while others lean toward speculative trades.

Analysts point out that even minor shifts in election results or candidate rhetoric can create ripple effects across crypto markets. This uncertainty influences market sentiment as investors gauge the likelihood of a favorable regulatory environment for digital assets.

Regulatory Clarity or Chaos?

The U.S. election outcome could either pave the way toward regulatory clarity or deepen existing ambiguities for the crypto industry. Trump’s pro-crypto attitude may foster a lenient regulatory environment, potentially encouraging rapid innovation and attracting investments. Harris’s focus on stability, however, might mean stricter guidelines that aim for consumer protection but could stifle growth.

- Trump’s Potential Impact: His win could lead to regulatory shifts promoting innovation, with policies possibly favoring the CFTC over the SEC.

- Harris’s Regulatory Perspective: A Harris-led administration could prioritize consumer protection, which may impact industry practices.

- Clarity vs. Control: The regulatory environment post-election could either support or limit the crypto market’s potential.

This regulatory direction could influence not only U.S.-based crypto companies but also global market sentiment, affecting how international investors approach U.S.-based digital assets. With most polls showing Trump’s lead, there is still some stability in the market.

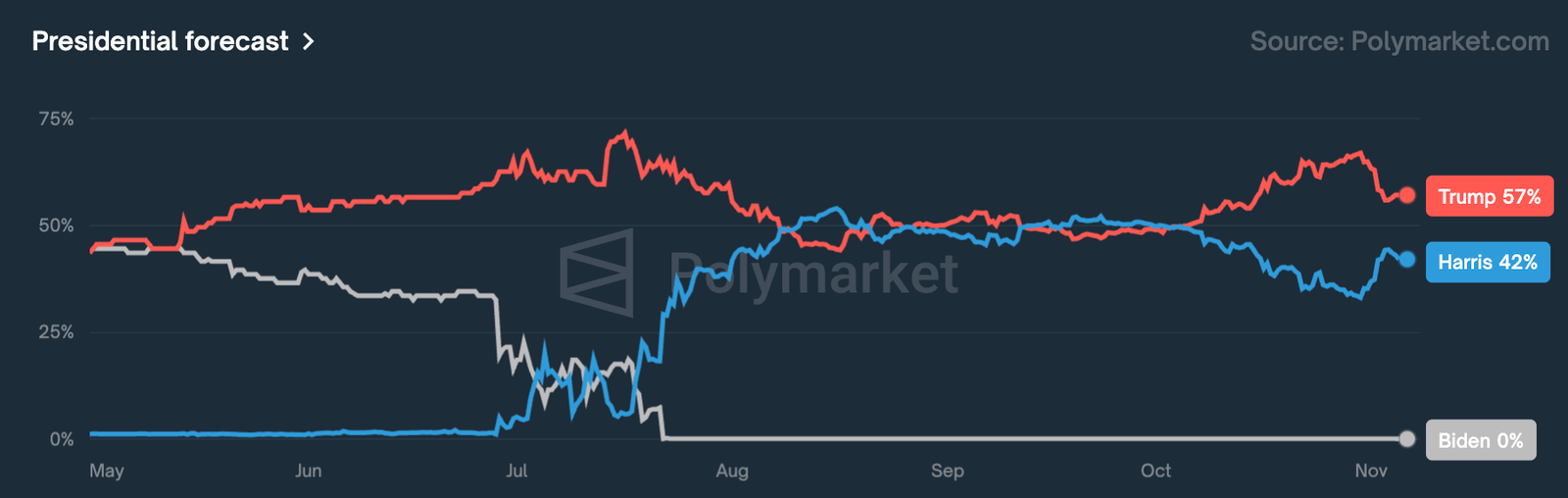

Check how the current polls shape up the US Election Scenario

Source : Polymarket

Crypto as a Voting Issue

Crypto’s role as a potential voting issue reveals its importance in American society, reflecting both economic interests and cultural shifts. Crypto enthusiasts have become a notable voter bloc, particularly in battleground states, where their influence could impact close races. This political mobilization emphasizes how integral cryptocurrency has become to American investors.

- Voting Power: With crypto holders growing in number, they have become a key demographic in elections.

- State-Specific Influence: The crypto community’s votes could be decisive in closely contested states.

- Policy Impact: Candidates who address crypto issues might gain an edge with these voters.

This phenomenon shows how blockchain technology is reshaping not only the financial landscape but also societal norms and political priorities in the U.S.

Macro-economic Factors and Crypto

While U.S. elections hold significant influence, broader economic factors also contribute to crypto market volatility. The Federal Reserve’s monetary policies, global economic trends, and major geopolitical events are additional drivers of crypto sentiment and value. The election’s outcome may establish the tone for future crypto-related regulations that respond to these macroeconomic pressures.

- Federal Reserve’s Role: Interest rate decisions and inflation policies impact market liquidity and crypto prices.

- Global Economics: Worldwide events, like trade agreements or conflicts, can affect crypto demand and supply.

- Long-Term Implications: The regulatory stance influenced by the election could set the stage for future macroeconomic responses to crypto.

Market players remain attentive to these factors, understanding that crypto’s integration with the global financial system will bring new challenges and dependencies.

Key Takeaways

✓ Political Influence on Crypto: The 2024 U.S. elections and Crypto markets highlight a growing trend—crypto is now a focal point in political campaigns, shaping the future of digital assets through policy influence.

✓ Trump’s Crypto Stance: A pro-crypto Trump administration may result in favorable policies, potentially positioning the U.S. as a global leader in the digital currency market. His commitment to economic growth resonates with crypto advocates who favor minimal regulation.

✓ Harris’s Cautious Approach: While Kamala Harris’s policies don’t directly oppose crypto, her economic platform emphasizes consumer protection. This could mean stricter regulatory measures for crypto markets, slowing rapid expansion.

✓ Market Reactions to Election News: The crypto market’s volatility increases with election-related updates, as investors react to candidate statements and shifts in projected outcomes.

✓ Voter Influence: With the growing crypto voter base, crypto issues may influence tight races, especially in battleground states. The community’s rising influence could play a role in shaping the election’s outcome.

✓ Regulatory Pathways: The election’s results will likely impact how and by whom crypto is regulated, which could either encourage innovation or impose limitations.

✓ Economic and Geopolitical Considerations: Beyond the election, macroeconomic factors like Federal Reserve policies and global economic events continue to influence crypto’s future, reflecting its connection to broader financial markets.

TL;DR

Below is a quick-reference guide to the terms and takeaways covered in this article.

- US Elections and Crypto: Elections hold significant sway over crypto policy; the 2024 race could determine regulatory pathways.

- Trump’s Crypto Position: Now pro-crypto, Trump’s stance promises a growth-friendly market with possible deregulation.

- Harris’s Regulatory Focus: Harris emphasizes consumer protection, possibly resulting in stricter oversight for crypto markets.

- Market Sensitivity: Crypto prices react to election updates, with Bitcoin and Ethereum showing heightened volatility.

- Crypto as a Voting Issue: For the first time, crypto has become a key voter issue, especially in swing states.

- Macro Factors: Beyond election results, Federal Reserve policies and global events also impact crypto’s value and stability.

This snapshot encapsulates the key takeaways from the 2024 election’s potential impact on the crypto market. Each candidate’s approach and subsequent regulatory path could influence not only the upcoming bull run but also crypto’s long-term role in the U.S. and global financial ecosystems.

Conclusion: A Pivotal Moment for Crypto

The 2024 U.S. elections represent a watershed moment for the cryptocurrency industry. Each candidate brings a unique approach, influencing the market’s regulatory expectations and potential for growth. Trump’s pro-crypto stance promises a favorable market, while Harris’s cautious approach could introduce stricter regulatory hurdles. The election’s impact on cryptocurrency may redefine the industry’s path, as crypto continues to establish its place within the broader financial ecosystem.