The Launch of Ethereum ETFs

The launch of Ethereum ETFs is a significant milestone for the crypto market. The demand generated by these ETFs could push Ethereum’s price to $5,000, $10,000, or even $20,000 by the end of next year. To understand the potential impact, let’s look at the effects of Bitcoin ETF approvals, the inflows and outflows from Bitcoin ETF funds, and what can be expected from their Ethereum counterparts.

Historical Impact of Bitcoin ETFs

Bitcoin ETFs have historically influenced Bitcoin’s price. The inflow of institutional money into Bitcoin ETFs has driven significant price increases. For example, after the Bitcoin ETF launched on January 10th, there was a noticeable rise in Bitcoin’s price from $40,000 to $70,000. This correlation between ETF demand and price increases provides a framework for predicting Ethereum’s future price movements.

Pros and Cons of Ethereum ETFs

Pros

- No Complex Self-Custody: For crypto beginners, managing private keys can be daunting. Ethereum eliminate this complexity.

- Insurance on Funds: Regulated funds offer protection and insurance on investments.

- Direct Exposure: ETFs provide direct exposure to Ethereum’s price, backed by real ETH coins.

- Tax Advantages: Investing in Ethereum ETFs through retirement accounts like Roth IRAs or 401(k)s offers tax benefits.

Cons

- No Real Custody: True crypto enthusiasts prefer holding their own ETH to maintain control and privacy.

- No Staking Income: ETFs do not provide staking rewards, resulting in a loss of approximately 4.4% annual income.

- No DeFi Income: Directly buying and deploying ETH in DeFi platforms can yield around 10% extra income annually.

Expected Inflows and Outflows

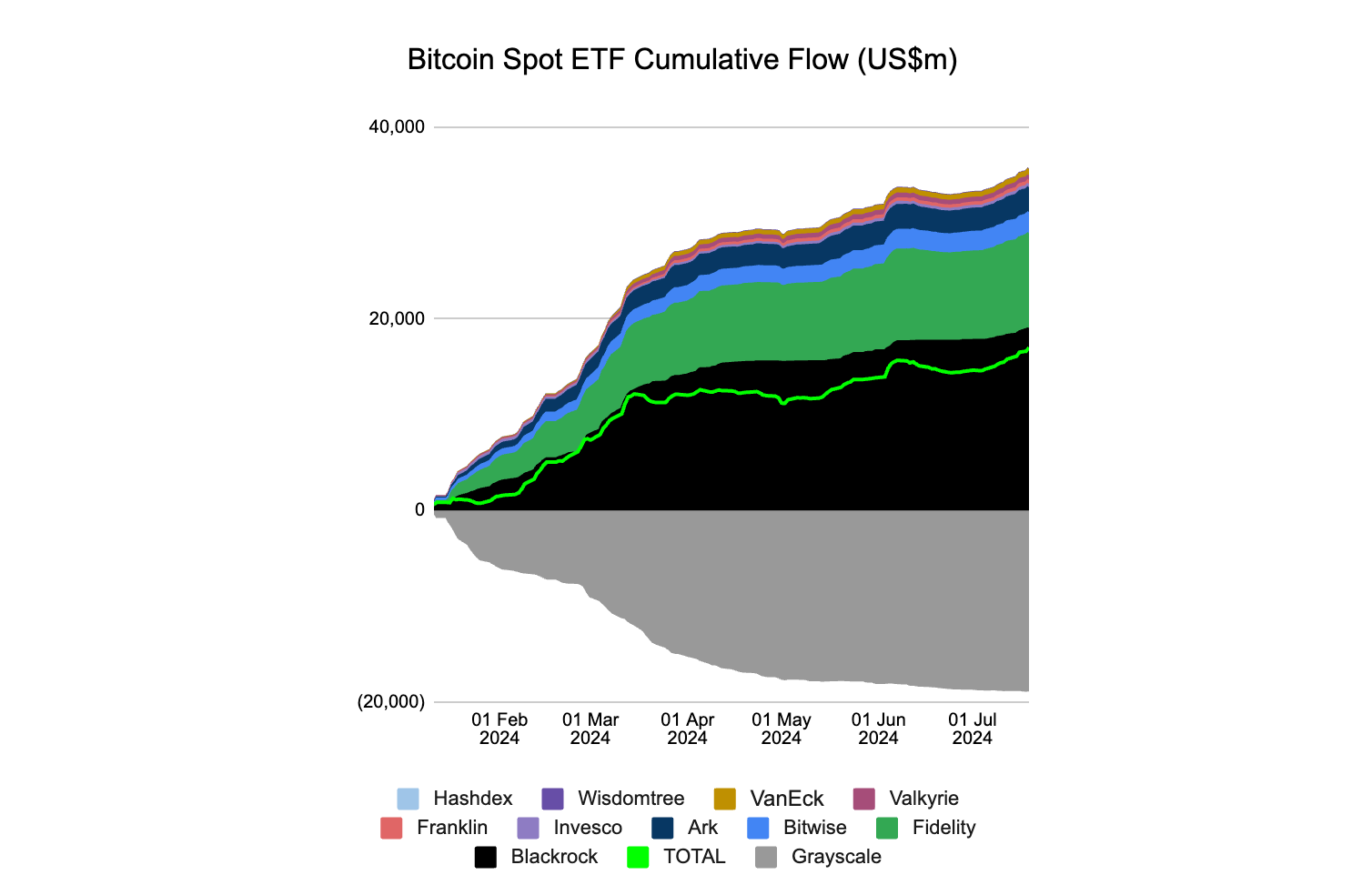

Galaxy’s research estimates significant inflows. Comparing the institutional demand for Bitcoin and Ethereum, the study predicts around $1 billion per month flowing into Ethereum ETFs. This estimate is based on the $15 billion inflow into Bitcoin ETFs over the last five months, annualized at $35 billion per year. This is based on the net ETF inflows we have seen in 6 months of Bitcoin ETFs which is distributed as follows. Blackrock has also annouced some relaxation with the rates which you can read here

Short-Term Price Impact of Ethereum ETFs

Initially, Ethereum might experience a dip similar to Bitcoin’s post-ETF launch due to potential outflows from the Grayscale Ethereum Trust. However, this is expected to be a short-term event. As institutional demand stabilizes, Ethereum’s price is likely to increase significantly. Analysts predict Ethereum could reach $5,300 by September and potentially $6,000 by the end of the year.

Long-Term Price Prediction

Looking ahead, Ethereum ETFs are anticipated to drive sustained interest and investment in Ethereum. The renewed interest in Ethereum could also boost related altcoins and DeFi platforms, creating a ripple effect throughout the ecosystem. This increased institutional adoption and broader acceptance of Ethereum as an investment could push ETH to new all-time highs, with some projections aiming as high as $15,000 to $20,000 by the end of 2025.

Key Points to Monitor

- Institutional Portfolio Allocation: Will institutions allocate funds to Ethereum ETFs at the same level as Bitcoin ETFs?

- Staking Integration: The impact of not having staking rewards in Ethereum ETFs could be significant. Monitoring any regulatory changes allowing staking within ETFs will be crucial.

- Ecosystem Growth: The inflow of institutional money into Ethereum ETFs could drive growth in the broader Ethereum ecosystem, including altcoins and DeFi platforms.

Conclusion

The introduction of Ethereum ETFs is a pivotal moment for the cryptocurrency market. With the potential to attract substantial institutional investment, Ethereum ETFs are poised to set a new all-time high for $ETH. By understanding the dynamics of ETF inflows, the historical impact of Bitcoin ETFs, and the pros and cons of investing in Ethereum ETFs, investors can better navigate this exciting development in the crypto space.