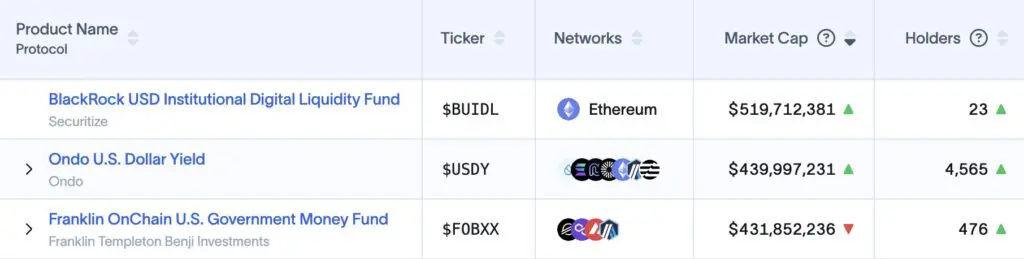

Ondo Finance has announced that its USDY token has achieved a major milestone, becoming the second-largest tokenized U.S. Treasury asset with over $439 million in total value locked (TVL). This development positions USDY ahead of Franklin Templeton’s FOBXX and highlights the growing interest in tokenized financial products, which offer blockchain-based access to traditional assets like U.S. Treasury securities.

USDY’s Rapid Growth in Tokenized Treasury Market

USDY’s swift rise in the tokenized U.S. Treasury market reflects increasing demand for tokenized assets, which enable investors to access government bonds using blockchain technology. As of October, USDY ranks second only to BlackRock’s tokenized treasury fund, a testament to investor confidence in Ondo Finance’s innovative real-world asset (RWA) tokenization approach. This milestone underscores USDY’s ability to provide a secure, liquid, and accessible investment option for those seeking exposure to U.S. Treasury bonds within decentralized finance (DeFi).

Benefits of Tokenized U.S. Treasury Assets

USDY and other tokenized U.S. Treasury assets represent a growing trend in the financial industry, offering several key advantages like accesibility, liquidity and transparency.

USDY’s rise to the second-largest tokenized treasury asset reflects its strong position in the evolving landscape of decentralized finance, where traditional financial products are digitized for greater flexibility and accessibility.

A Growing Trend in De-Fi

As tokenization gains traction, Ondo Finance’s USDY is well-positioned to attract more investors seeking yield-enhanced alternatives within the blockchain space. This success is indicative of a broader trend, with more institutions exploring tokenization as a way to offer accessible, secure, and liquid investment opportunities.

As USDY continues to grow, it signals the increasing mainstream acceptance of blockchain-based financial products. With strong demand for yield-bearing and transparent assets, USDY’s rise reflects the broader shift toward tokenized finance, which blends the best of traditional financial instruments with the innovative potential of blockchain technology.

Disclaimer: USDY is not available in the U.S. or to U.S. persons. Acquiring USDY involves risks, including potential losses, and it is not registered under U.S. securities laws.