The US Federal Reserve will announce its fifth interest rate decision for 2024 later tonight (July 31) after a two-day FOMC Meeting. Wall Street expects the US central bank to keep the benchmark interest rates between 5.25% – 5.50%. However, market participants will focus on hints that lift bets of a rate cut in September.

Current Economic Landscape

- Inflation Trends: US inflation has been falling closer to the Fed’s 2% target.

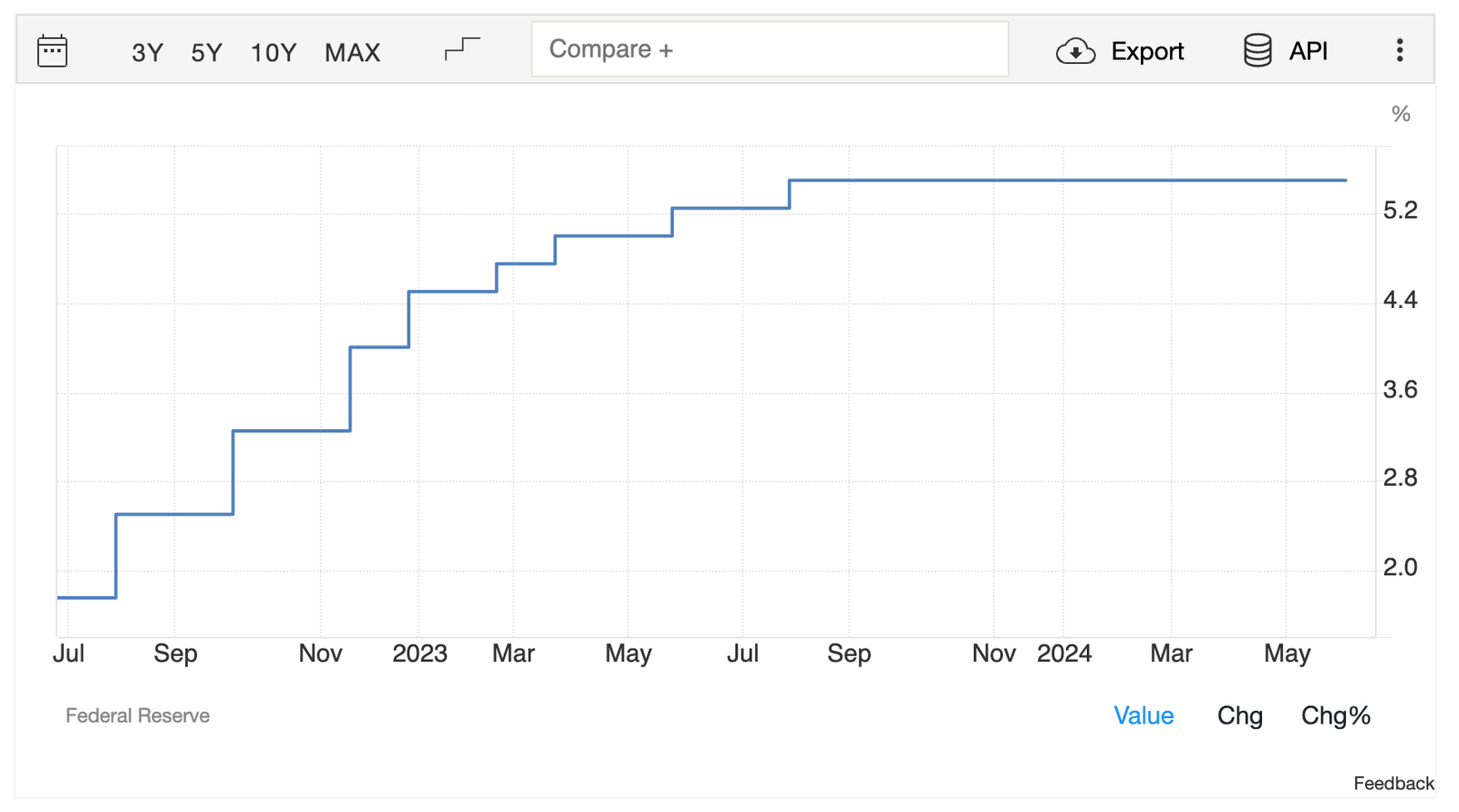

- Interest Rates: The Fed has maintained its key overnight interest rate at the 23-year high mark since July 2023.

- Fed’s Stance: The Fed is inclined to reduce rates only when confident inflation is sustainably moving towards the 2% level.

Market Reactions and Predictions

At its previous monetary policy meeting on June 12, the Powell-led FOMC unanimously voted to hold the policy rate at the two-decade high mark for the seventh straight meeting. Wall Street expects the US Fed to hold rates steady in July. Analysts and economists predict a dovish commentary by Fed chair Jerome Powell, which could indicate potential rate cuts in September.

Source : TradingEconomics

Key Factors Influencing Rate Decisions

- Data-Dependent Projections: Fed policymakers frequently revise plans for rate hikes or cuts depending on economic growth and inflation trends.

- Market Sentiment: Analysts are optimistic as slower inflation readings boost expectations for a rate cut.

- Tech Stock Reactions: Market sentiment and futures pricing strongly suggest a rate cut.

Potential Impact on Crypto Market

The anticipated FOMC meeting could have significant effects on the crypto market. Lower interest rates typically lead to increased liquidity and risk appetite among investors. Here’s how:

- Increased Liquidity: Lower rates make borrowing cheaper, increasing the availability of funds for investment in cryptocurrencies.

- Risk Appetite: A reduction in interest rates often leads to higher risk tolerance among investors, boosting demand for high-risk assets like cryptocurrencies.

- Market Sentiment: Positive market sentiment around the FOMC meeting can lead to bullish trends in the crypto market.

Conclusion

The FOMC meeting on July 31 is poised to be a pivotal event for financial markets, including the crypto market. With inflation nearing the Fed’s target and the job market cooling, the potential for a rate cut is high. This development could lead to increased liquidity and risk appetite, benefiting the crypto market. As the FOMC meeting approaches, investors will be closely watching for any signals from the Fed that could influence their investment strategies.

By understanding the dynamics at play in the FOMC meeting, crypto investors can better position themselves to capitalize on potential market movements.