Bitcoin remains resilient at $100,000, while altcoins face heavy losses following President Donald Trump’s announcement of new tariff on Canada, Mexico, and China. The move has triggered a major sell-off in the crypto market, with investors seeking safety in BTC as uncertainty looms.

Bitcoin Steady, Altcoins Hit Hard

Despite the turmoil, Bitcoin (BTC) has maintained its ground around $100K, reinforcing its reputation as a safe-haven asset. However, the altcoin market is bleeding, with major tokens experiencing double-digit losses:

📉 Ethereum (ETH): Down -12.3%

📉 Solana (SOL): Down -15.7%

📉 Cardano (ADA): Down -17.5%

With over $534 million in liquidations, traders are shifting funds into Bitcoin, avoiding higher-risk altcoins amid fears of a worsening trade war.

Bitcoin Move After Trump’s Tariff Spark Turmoil

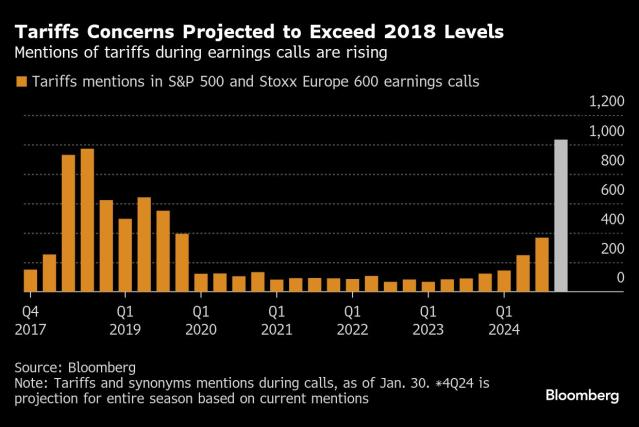

Key Development: President Trump’s tariff hike on imports from Canada, Mexico, and China has raised concerns over global economic instability.

https://www.bloomberg.com/Source : Bloomberg

🔸 Impact on Crypto:

- Increased fear of inflation and interest rate hikes

- Traders favoring BTC over volatile altcoins

- Stock and commodity markets also reacting negatively

The market’s reaction highlights Bitcoin’s growing role as a hedge during times of political and economic uncertainty.

What’s Next for Bitcoin and Altcoins?

Market analysts are split on how crypto will respond moving forward:

Bullish Outlook: Some expect Bitcoin to rally beyond $100K as investors seek protection against inflation and economic turbulence.

Bearish Warning: Others caution that rising interest rates could pressure all risk assets, including BTC. This is also based on the weekly bearish divergence which is still active

For now, altcoins remain under heavy selling pressure, and the crypto market is bracing for further volatility if geopolitical tensions escalate.