16th February, 2026 – Binance CEO Richard Teng has pushed back against a recent Fortune report, calling it “misleading” and demanding corrections. The article claimed Binance fired compliance staff after they flagged $1B+ in Iran-linked Tether (USDT) transactions. The dispute highlights ongoing regulatory pressure on Binance following its 2023 U.S. settlement.

High Signal Summary For A Quick Glance

- Binance has denied allegations of sanctions breaches and retaliatory employee firings.

- Claims center around over $1B in Iran-linked USDT transactions processed through the platform.

- Previous scrutiny, including the 2023 DOJ settlement, was followed by eventual market stabilization.

- The situation reinforces ongoing compliance and regulatory pressure facing major crypto exchanges.

- Retail traders: May face short-term volatility in BNB and exercise caution when trading on Binance.

- Long-term holders: Regulatory uncertainty could affect confidence in BNB’s long-term outlook.

- Institutions: Large investors and liquidity partners may reassess exposure or counterparty risk.

- Broader market: Increased scrutiny on exchanges and major stablecoins such as USDT.

What Led to the Controversy?

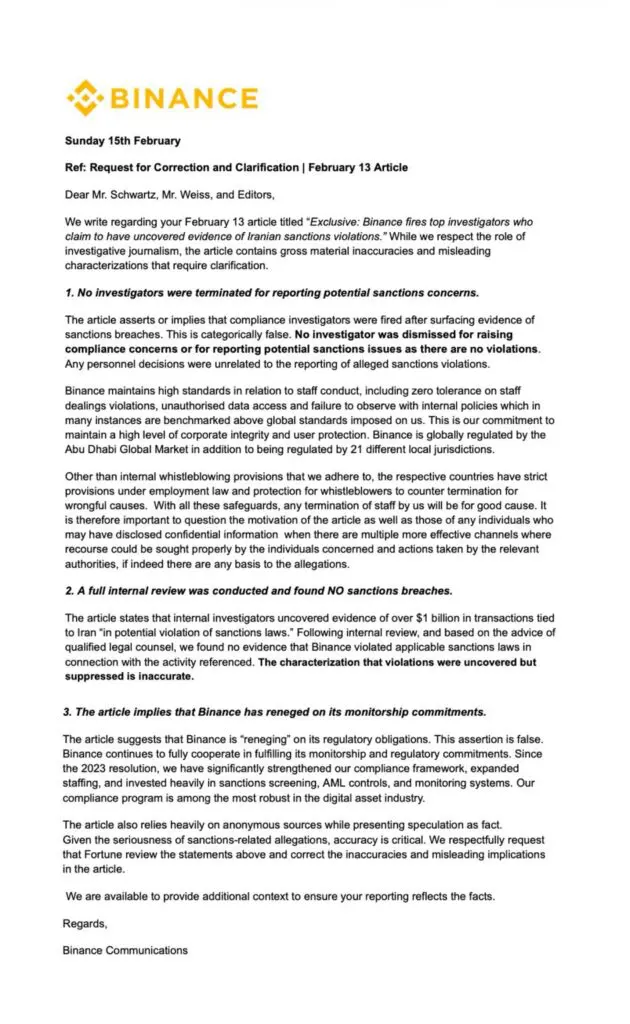

In a February 13, 2026 report, Fortune alleged that Binance fired at least five compliance investigators after they flagged over $1 billion in Tether transactions tied to Iranian entities between March 2024 and August 2025, potentially breaching U.S. sanctions.

Binance CEO Richard Teng rejected the claims, calling the report “misleading” and stating that no sanctions violations occurred. He also said the employee dismissals were not related to whistleblowing.

The report comes as Binance continues rebuilding its compliance image following its 2023 $4.3 billion settlement with U.S. authorities over anti-money laundering and sanctions violations, including dealings involving sanctioned countries like Iran. After that settlement, BNB initially dipped but later surged more than 20% as investor confidence improved.

Key milestones in Binance’s alleged Iran-linked transactions controversy and response

$4.3B DOJ settlement and leadership change

Binance agrees to a $4.3B settlement with the U.S. DOJ over AML and sanctions violations; Changpeng Zhao steps down and Richard Teng becomes CEO.

Alleged Iran-linked USDT transfers flagged

Investigators reportedly identify over $1B in Tether transfers tied to Iran on the Tron network, raising compliance concerns.

Compliance staff reportedly dismissed

At least five compliance team members are allegedly fired after raising internal concerns about sanctions-related transactions.

Fortune publishes investigative report

Fortune releases an article detailing alleged Iran-linked transactions and internal compliance concerns at Binance.

Binance denies allegations

CEO Richard Teng publicly rejects the claims, calling the report misleading and reaffirming Binance’s compliance standards.

CZ publicly responds

Changpeng Zhao dismisses the allegations on X, describing the report as biased and defending Binance’s integrity.

Recent Updates

Recent Updates

On February 15, 2026, Fortune updated its report to include a response from Binance and Binance CEO Richard Teng. The exchange said no staff were fired for reporting sanctions concerns and that an internal legal review found no violations.

Binance also highlighted its use of third-party monitoring tools and cooperation with law enforcement. However, the article still references $1B+ in Iran-linked Tether (USDT) transactions. Reactions on X remain mixed, with some calling it FUD and others demanding greater transparency.

What Readers should Watch Next

Regulatory Responses: Watch for comments or action from U.S. authorities like the DOJ or OFAC over the claims involving Binance. Any probe or penalty could raise risks.

Binance CEO & Compliance Updates: Look for further statements from Binance CEO Richard Teng on stronger monitoring tools or team expansion to rebuild trust.

Market Sentiment & BNB Price: Track BNB price and volume. A rebound like post-2023 could signal easing FUD.

Media Follow-Ups: Watch for updates from Fortune or new reports that could escalate or clarify the story.