As the crypto world evolves, its language also grows more complex. For newcomers, this can seem daunting. However, understanding advanced crypto terms is crucial for navigating the blockchain technology. These terms go beyond basic concepts, diving into specialized mechanisms and protocols that shape how cryptocurrencies operate and maintain value. In this article, we’ll explore critical terms every crypto enthusiast should know, particularly if they aim to make informed decisions in a rapidly changing environment.

These terms can help you better understand project roadmaps, evaluate token value, and assess new developments in blockchain technology. With advanced knowledge of crypto-specific terminology, you can make smarter, data-driven choices when investing, trading, or simply exploring the vast world of digital assets.

Core Financial Crypto Terms

Token Generation Event (TGE)

A Token Generation Event (TGE) marks the initial distribution of a cryptocurrency token to the public, typically following a funding phase. In a TGE, tokens are released and made available for trading, often following fundraising rounds like private sales or Initial Coin Offerings (ICOs). The goal is to give early supporters access to tokens that can be used in the project ecosystem or traded on exchanges. Unlike ICOs, which emphasize raising funds, TGEs focus on creating and releasing the token itself, making it a pivotal step for any crypto project. You can learn more about TGE in this article

Total Value Locked (TVL)

Total Value Locked (TVL) refers to the combined value of assets locked in a decentralized finance (DeFi) protocol. When users deposit funds into a DeFi platform’s liquidity pool or lending protocol, the protocol’s TVL increases, showcasing its popularity and reliability. High TVL typically suggests strong community trust, signaling to investors that the platform is secure and in demand. In essence, TVL measures the capital flowing into DeFi platforms, helping users gauge the network’s activity level and growth.

Impermanent Loss

Impermanent loss occurs when providing liquidity to a DeFi pool leads to a decrease in asset value compared to simply holding the asset. Liquidity providers face impermanent loss when token prices fluctuate significantly after depositing funds into a pool. For example, in an ETH/USDT pool, if ETH’s price doubles while funds remain locked, the liquidity provider may experience a “loss” compared to holding ETH alone. This term is crucial for those considering liquidity provision, as it affects potential returns, especially in volatile markets.

Flash Loans

Flash loans are uncollateralized, short-term loans typically executed within seconds on a DeFi platform. Unlike traditional loans, flash loans must be repaid within a single transaction block, or they are voided. Often used for arbitrage opportunities, flash loans let traders exploit price differences across exchanges, benefiting from rapid transactions. Despite their innovative nature, flash loans are risky and have been used in some high-profile DeFi attacks. Flash loans give experienced traders powerful tools but are complex and require caution.

Crypto Terms for Token Value Management

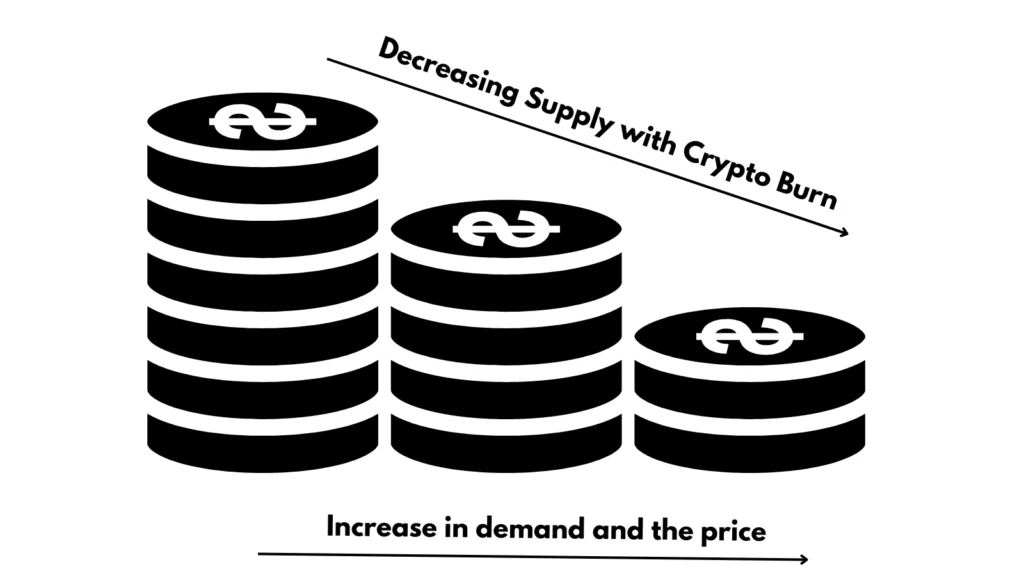

Crypto Burn

Burns permanently remove a certain number of tokens from circulation, effectively reducing total supply. Token burns work by sending tokens to a “burn address,” a wallet without a private key, meaning the tokens cannot be recovered. The goal is to create scarcity, often aiming to increase token value by limiting the circulating supply. Binance Coin (BNB), for instance, uses token burns quarterly to reduce supply, potentially boosting the token’s market price. Burns can reassure investors by demonstrating the team’s commitment to long-term value. You can learn more about this term here

Proof of Burn (PoB)

Proof of Burn (PoB) serves as a consensus mechanism that validates transactions by “burning” tokens, effectively removing them from circulation. In PoB, miners send tokens to a burn address and receive mining rights in return, allowing them to validate transactions. This process grants network security, similar to Proof of Stake (PoS) or Proof of Work (PoW). Unlike PoW, however, PoB consumes fewer resources, making it an environmentally friendlier alternative. In addition, PoB aligns with long-term token scarcity, potentially increasing value as tokens are continuously burned.

Rebasing

Rebasing is an algorithmic process that adjusts a token’s supply based on its target price. Instead of targeting a fixed supply, rebasing projects like Ampleforth (AMPL) control supply to match price goals, expanding or contracting token amounts as needed. If the price of a rebasing token exceeds the target, the protocol issues more tokens to bring the price down. Conversely, if the price falls, it reduces supply to drive value up. This concept is unique to algorithmic stablecoins and provides an unconventional method for maintaining price stability without relying on fiat collateral.

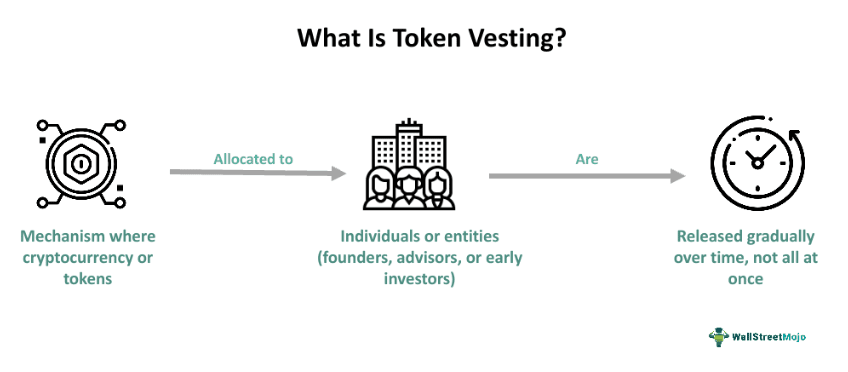

Token Vesting

Token vesting schedules control when team members, advisors, or investors can access their allocated tokens, reducing the risk of large sell-offs shortly after a token’s release. Vesting schedules typically lock tokens for a specified period, then release them gradually. By slowing the release of new tokens, vesting prevents price volatility, contributing to a stable token economy. This approach builds investor confidence, as it demonstrates the team’s commitment to the project’s growth over time rather than a rapid exit.

Source : WallStreetMojo

Consensus Mechanisms in Blockchain

Proof of Stake (PoS)

Proof of Stake (PoS) is a consensus mechanism where validators are chosen to create new blocks based on the amount of cryptocurrency they “stake” or lock up in the network. Unlike Proof of Work (PoW), which uses computational power to validate transactions, PoS relies on staking. Validators are chosen based on their stake and duration in the network, rewarding them for honest behavior. This mechanism consumes significantly less energy, making it an attractive, eco-friendly alternative. Networks like Ethereum recently switched to PoS, aiming to enhance security while lowering environmental impact.

Proof of Work (PoW)

Proof of Work (PoW) is one of the earliest consensus algorithms used in blockchain, with Bitcoin as its first major implementation. In PoW, miners compete to solve complex mathematical puzzles. The first miner to solve a puzzle validates a transaction block and receives a reward in return. PoW’s primary drawback is its high energy consumption. However, it remains one of the most secure consensus mechanisms. Its intense computational requirements make tampering difficult, preserving network integrity. PoW’s security, combined with its robust track record, keeps it popular, especially for Bitcoin and similar assets.

Delegated Proof of Stake (DPoS)

Delegated Proof of Stake (DPoS) in relatively newer as compared to other common crypto terms. It introduces a governance-based variant of the PoS model. Token holders in DPoS elect a specific number of delegates to validate transactions and secure the network. These delegates, or “validators,” share the block rewards with the users who vote for them. This structure increases transaction speed and reduces energy requirements, making it efficient for networks like TRON and EOS. However, DPoS has critics who point out that it centralizes power among a few delegates, potentially reducing true decentralization. Still, DPoS offers a highly efficient model for certain applications.

Key Metrics for Assessing a Project

Market Cap

Market capitalization, or “market cap,” measures the total value of a cryptocurrency. It is calculated by multiplying the token price by its circulating supply. Market cap categories include large-cap, mid-cap, and small-cap. Large-cap projects often have established reputations and stability, attracting risk-averse investors. In contrast, small-cap projects offer high growth potential but come with higher volatility. Market cap helps investors assess project size and risk, providing a broad view of the token’s standing in the crypto market. Understanding this metric is essential for evaluating any cryptocurrency.

Trading Volume

Trading volume is one of the most widely used crypto terms by traders. It represents the total quantity of a cryptocurrency traded within a specific period. High trading volume often indicates strong liquidity, meaning assets can be bought or sold quickly. Volume spikes frequently coincide with significant price moves, signaling either increased buying interest or intense selling pressure. Monitoring trading volume helps investors identify trends and anticipate price volatility. Consistent high volume usually indicates robust market interest, while low volume might signal reduced activity or even waning interest in the asset. Green volume ( in the graphic below ) means incoming volume while red is outgoing.

Liquidity

Liquidity refers to how easily a cryptocurrency can be bought or sold without affecting its price. High liquidity benefits traders by allowing quick, stable trades even with large amounts of capital. Several factors impact liquidity, including trading volume, number of exchanges listing the asset, and user engagement. High liquidity supports stable prices and enhances user confidence. In contrast, low liquidity increases price volatility and can complicate trade execution. Therefore, liquidity is essential for evaluating project viability, particularly for new or low-cap assets.

Token Economics and Utility

Staking

Staking involves locking up tokens in a network to support its operations, particularly in PoS and DPoS blockchains. In return, stakers receive rewards, either in additional tokens or interest. Staking benefits both the network and the user; the network gains security, while the user earns passive income. Staking options vary between projects, with some offering high yields to incentivize participation. However, staking often requires a minimum lock-in period, limiting liquidity. Staking has gained popularity as it offers consistent returns, especially for those seeking passive income.

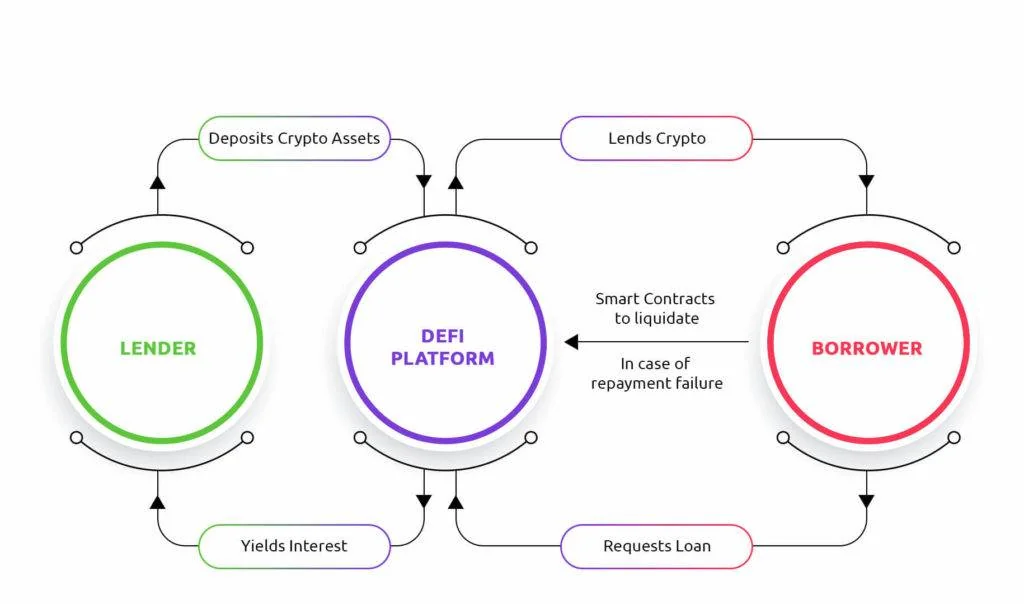

Yield Farming

Yield farming is a decentralized finance (DeFi) strategy where users provide liquidity to a protocol, often a lending or borrowing platform, to earn rewards. Farmers deposit tokens into liquidity pools, which others can use for transactions or loans. The protocol rewards users with token incentives, often distributed as additional tokens. Yield farming can generate high returns, but it comes with significant risks, including impermanent loss and fluctuating token prices. The strategy is complex and often appeals to experienced DeFi users. However, yield farming contributes to DeFi’s growth by providing liquidity and fostering innovation.

Token Utility

Token utility defines the purpose of a token within its ecosystem. A utility token grants access to certain services, voting rights, or staking opportunities within a platform. For example, Binance Coin (BNB) offers fee discounts on the Binance exchange, while Uniswap’s UNI token allows users to vote on protocol changes. A token’s utility can impact its value by increasing demand. If a token has several use cases, it attracts more users, thus strengthening its ecosystem. Understanding a token’s utility helps investors assess its long-term potential.

Governance in Crypto Projects

Decentralized Autonomous Organizations (DAOs)

DAOs represent a unique organizational structure that operates without centralized control. They use blockchain-based smart contracts to enforce rules, and decisions are made through community votes. Token holders in a DAO can propose and vote on changes, directly influencing the project’s direction. DAOs prioritize transparency and decentralization, with funds, processes, and actions visible to members. Projects like MakerDAO and Uniswap rely on this model, allowing community-driven development. However, DAOs also present challenges, such as governance gridlock and potential vulnerabilities in smart contract code. For decentralized projects, DAOs enhance democracy and community participation.

Voting Power and Token Governance

In many blockchain projects, voting power depends on the number of tokens a user holds, with more tokens equating to more influence. This model allows token holders to vote on project updates, protocol changes, or governance policies. Some protocols, like Compound and Aave, grant token-based voting rights, where holders can delegate votes to trusted members. However, token-based governance can sometimes centralize control in the hands of large holders or institutions. This system strives to balance decentralization with effective decision-making, empowering the community while maintaining a streamlined approach to governance.

Security and Risk Management Crypto Terms

Smart Contract Audits

A smart contract audit is a thorough review of a smart contract’s code to identify vulnerabilities or potential risks. Independent third-party firms usually conduct these audits, providing an impartial assessment. Audits help prevent hacks, safeguard user funds, and enhance project credibility. Audits are essential in DeFi, where smart contracts handle large sums of money. Projects with well-audited contracts tend to attract more investors, as audits build confidence. While audits don’t eliminate all risks, they significantly reduce the chance of code exploits, providing crucial security layers.

Multi-Signature (Multisig) Wallets

A multisig wallet requires multiple private keys to approve a transaction. In essence, it spreads control across multiple users, reducing the risk of fraud or unauthorized access. Multisig wallets are standard in DAOs and investment funds, where security is paramount. They provide an extra layer of security, making it harder for one individual to act without consensus. However, multisig setups require careful key management, as lost keys could lock funds permanently. By distributing control, multisig wallets offer a safeguard against potential breaches or insider threats, enhancing project security.

Important Metrics for Investor Analysis

Fully Diluted Valuation (FDV)

Fully Diluted Valuation (FDV) represents the value of a cryptocurrency if all its potential tokens were in circulation. This metric is calculated by multiplying the token’s current price by its maximum supply. FDV helps investors understand a project’s hypothetical upper limit, offering a more comprehensive valuation perspective. While market cap reflects the current valuation, FDV shows a “what-if” scenario, aiding long-term investment decisions. Investors can use FDV to gauge if a project is undervalued or overvalued relative to its future potential.

Impermanent Loss

Impermanent loss occurs when an investor provides liquidity in a two-token pool, and the prices of the paired assets diverge. This divergence reduces the value of the pool, causing a potential loss. This loss is called “impermanent” because if asset prices realign, it disappears. However, significant, long-term price disparities lead to realized losses. Impermanent loss is particularly relevant in yield farming, where it can reduce returns. Liquidity providers often accept impermanent loss in exchange for pool rewards, but it remains a considerable risk in DeFi investments.

TL;DR – Quick Reference of Crypto Terms

- Token Generation Event (TGE): Launch event where a project issues a new cryptocurrency to the market.

- Total Value Locked (TVL): Represents all assets locked in a DeFi protocol, reflecting its popularity and reliability.

- Crypto Burn: Permanently removing tokens from circulation, often boosting the asset’s value by reducing supply.

- Proof of Stake (PoS): Consensus mechanism where validators “stake” tokens to secure the network.

- Proof of Work (PoW): Mechanism in which miners use computational power to validate transactions.

- Market Cap: The total market value of a cryptocurrency, calculated by price x circulating supply.

- Trading Volume: Shows liquidity by tracking the total quantity of a cryptocurrency traded within a specific period.

- Staking: Process of locking tokens to support a blockchain network and earn rewards.

- Yield Farming: DeFi strategy where users provide liquidity in exchange for rewards.

- DAO (Decentralized Autonomous Organization): Community-run organization governed by smart contracts.

- Smart Contract Audit: Third-party code review to identify vulnerabilities in smart contracts.

- Multi-Signature Wallets: Wallets that require multiple signatures to approve transactions, enhancing security.

- Fully Diluted Valuation (FDV): Valuation if all tokens are circulating, projecting total market potential.

- Impermanent Loss: Value reduction when paired token prices in a liquidity pool diverge significantly.

Key Takeaways

- Crypto Vocabulary Essentials: Mastering complex crypto terms sharpens investor knowledge and improves decision-making.

- Managing Risk through Knowledge: Terms like impermanent loss, audits, and multisig wallets guide investors in managing and assessing risks.

- Consensus Mechanisms’ Impact: Mechanisms like PoS and PoW define network security and energy efficiency.

- DeFi and Tokenomics: Concepts like TVL and staking help in evaluating DeFi projects and understanding token functionality.

- Governance in Crypto: DAOs and token-based voting drive decentralized decision-making, reflecting crypto’s evolving landscape.

Conclusion

Understanding critical crypto terms opens up new insights for anyone venturing into this space. This article covered a range of essential terms, from consensus models to DeFi concepts and governance. Learning these terms builds confidence and enables better interaction with blockchain systems. Investors who grasp key concepts, such as market cap, FDV, and impermanent loss, can make more informed choices. As the crypto industry advances, staying informed empowers you to capitalize on opportunities and manage risks, ensuring you’re prepared for what’s next in this dynamic market.