The Ethereum ETF finally went live on the 23rd of July 2024 after years of drama between the SEC and Ethereum. 7 months after Bitcoin ETF’s launch, which was the largest ever ETF launch, Ethereum’s performance was solid as well. Experts ranking it either above or below gold, which was the second largest launch.

The Journey Of The ETF

The SEC has historically been very cautious about cryptocurrency ETFs, which is why both Ethereum and Bitcoin ETFs have encountered many rejections and delays. I was surprised to learn during my research for this article that the first application for a Bitcoin ETF was submitted as far back as 2013 🤯.

The situation with Ethereum was even more challenging due to the SEC’s position on the security classification of Ethereum and the complexities surrounding $ETH staking.

In August 2023, Grayscale Investments successfully challenged the SEC in court, setting the stage for major developments. The SEC’s approval of the Bitcoin ETF in January 2024 marked a significant milestone for the entire industry and paved the way for Ethereum ETFs. By May 2024, the SEC had approved 19b-4 filings from several major financial institutions, including VanEck, BlackRock, Fidelity, Grayscale, and others, allowing spot Ethereum ETFs to be listed and traded on exchanges like NYSE Arca and CBOE.

The Ethereum ETF list

- Fidelity Ethereum Fund (FETH):

- Fee: 0.25%

- Promotional Offer: Fee waived until December 31, 2024.

- VanEck Ethereum Trust (ETHV):

- Fee: 0.20%

- Promotional Offer: Fee waived for the first 12 months of trading or first $1.5 billion in fund assets, whichever comes first.

- Franklin Ethereum Trust (EZET):

- Fee: 0.19%

- Promotional Offer: Fee waived until January 31, 2025, or first $10 billion in fund assets, whichever comes first.

- 21Shares Core Ethereum ETF (CETH):

- Fee: 0.21%

- Promotional Offer: Fee waived for the first six months of trading or first $500 million in fund assets, whichever comes first.

- Bitwise Ethereum ETF (ETHW):

- Fee: 0.20%

- Promotional Offer: Fee waived for the first six months of trading or first $500 million in fund assets, whichever comes first.

- iShares Ethereum Trust (ETHA) [BlackRock]:

- Fee: 0.25%

- Promotional Offer: Fee reduced to 0.12% for the first $2.5 billion in fund assets.

- Grayscale Ethereum Mini Trust (ETH):

- Fee: 0.25%

- Promotional Offer: Fee reduced to 0.12% for the first 12 months of trading or first $2 billion in fund assets, whichever comes first.

- Invesco Galaxy Ethereum ETF (QETH):

- Fee: 0.25%

- Promotional Offer: No promotional offer specified.

Then there’s Grayscale which is charging a 2.5% fee. I’ll be really honest here, I do not know their play with this one but they have also launched a new product called the Grayscale Eth Mini Trust which offers a competeitive fee.

The Ethereum ETF first week performance

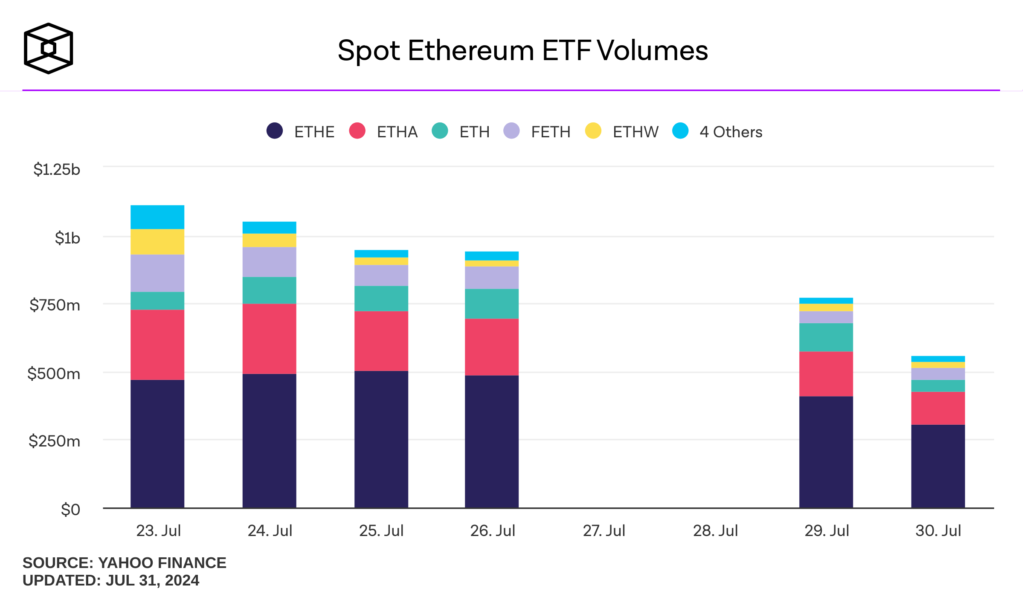

The first day was brilliant for the Ethereum ETF with $1.1B in trading volume and $600M in inflows. Grayscale had the outflows but that was already predicted.

Trading volume is a vital indicator at the launch of any ETF to determine how interested are the consumers in that particular asset and to make sure its not just a handful of people who are interested in that asset without a wider market demand. Some experts speculate that the Ethereum spot ETF was probably the third most impressive launch after Gold and obviously Bitcoin.

Eventually over the week though, in a report by The Business Times we saw an outflow of $340M . More than $1.5 billion of exits from Grayscale’s high-fee Ethereum Trust more than offset inflows into the other spot products.

Src: The Block

The spot Ethereum ETFs saw a cumulative trading volume of $4.05 billion in their first week, making up 34% of the $11.82 billion volume recorded by spot Bitcoin ETFs in their first four days post-launch.

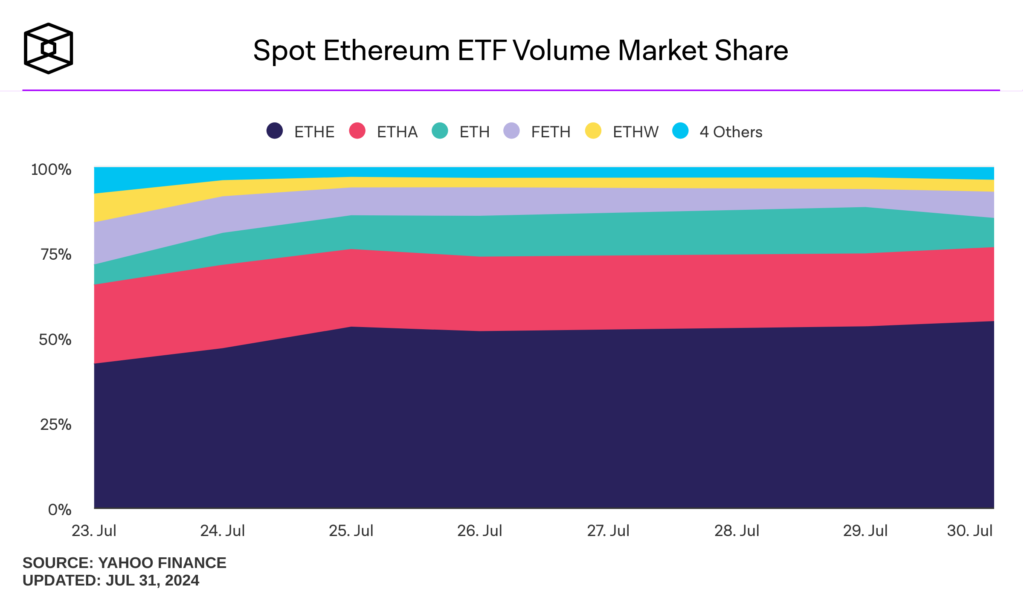

Grayscale’s ETHE led the way with a market share of around 52% on Friday, followed by BlackRock’s ETHA at 21.7%, Grayscale’s ETH at 12%, and Fidelity’s FETH at 8.4%.

Although trading volume for Bitcoin ETFs has decreased since their launch, Ethereum ETFs captured 55% of the $7.35 billion trading volume for Bitcoin ETFs during the same period last week. It’s still early, and the Ethereum ETFs might see a slowdown after the initial excitement. However, inflows (excluding ETHE and GBTC) and trading volume exceeded analysts’ expectations, representing a larger proportion of the Bitcoin ETFs’ figures than the anticipated 15-25%.

Ethereum ETF: Effect on the price?

Now this is where it gets interesting. At the time of the ETF launch, Ethereum was priced at $3,487. Despite the significant $600 million in inflows on the first day and a “solid A” launch, the price of $ETH initially dropped to $3,072 on July 25th.

At the time of writing, 1st Aug 2024, the price of $ETH is $3,177. We have seen a week of pump and then last two days of dump in the entire crypto market and Ethereum just seems to be following that.

What we must remember though is that Bitcoin after its ETF saw a dump for a couple of weeks before setting a new ATH, maybe the same with ETH now?