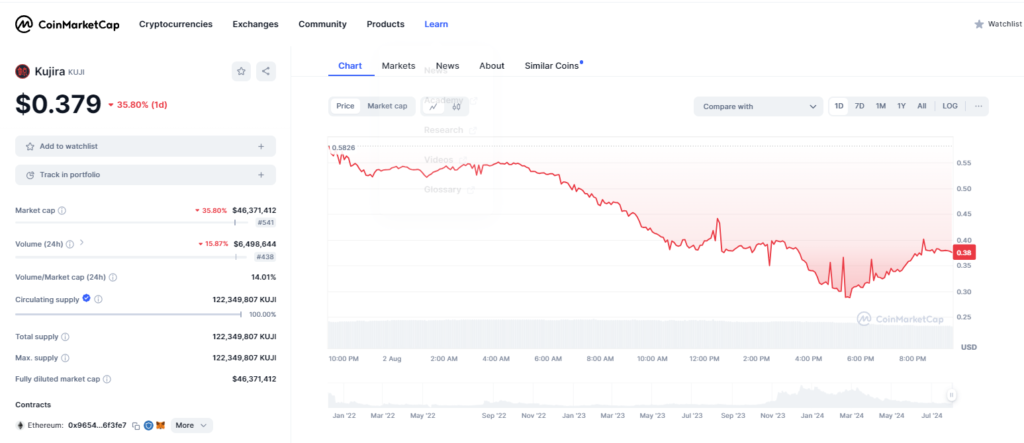

Major Drop in KUJI Token Value

The Kujira Foundation, known for its decentralized finance (DeFi) initiatives, suffered a dramatic 55% plunge in the value of its KUJI tokens within a single day. This drastic decline followed the liquidation of leveraged positions by the foundation’s operational wallet, leading to significant losses and exacerbating the token’s price fall.

Liquidations and Market Volatility

The trouble began when the Kujira Foundation’s leveraged liquidity positions became undercollateralized amid market volatility. This misstep triggered automatic liquidations of KUJI holdings, further driving down the token’s value in a downward spiral. The foundation’s attempts to use leveraged positions to boost liquidity backfired, resulting in millions of dollars in bad debt.

Plan to Establish a DAO

In response to the crisis, the Kujira team announced plans to establish a decentralized autonomous organization (DAO). This new entity will manage the Kujira Treasury and core protocols, aiming to stabilize the situation by reducing debt and enhancing transparency. The DAO will also oversee protocol configurations and enable community proposals through a blockchain-based voting system.

Current Financial Status

At its peak in March 2024, Kujira had over $124 million in locked funds. By earlier this week, this figure had dropped to $50 million, and it fell further to $35 million by Friday morning due to ongoing liquidations. The foundation is now focusing on restructuring and implementing safeguards to prevent future issues.

Moving Forward

The creation of the DAO represents a strategic move to regain control and restore stability within the Kujira ecosystem. The foundation is committed to addressing the financial challenges and improving transparency through this new governance structure.